About Us

With Whole Life or Universal Life insurance policies----otherwise known as "cash value" life insurance---you pay premiums in return for a cash account inside the policy, plus a tax free death benefit paid to your beneficiaries when you die. The exact amount of your cash value fluctuates based on (a) the premiums you pay plus (b) how much interest your cash value earns, minus (c) the insurance company’s expenses.

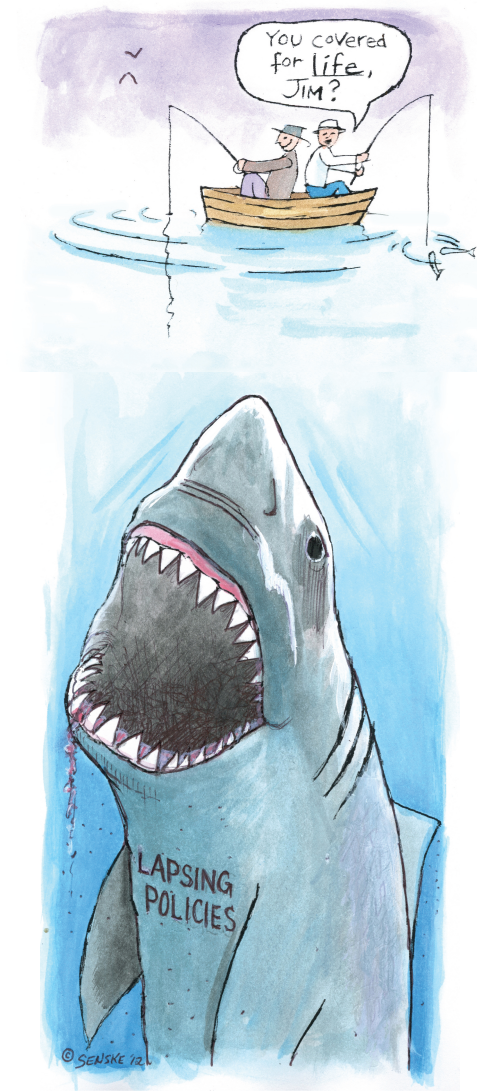

The problem is that most Universal and Whole Life policy owners don’t pay much attention to their cash value. They don’t analyze how much interest they are getting or how much the insurance company is charging them for expenses over time. Consequently, if your policy’s interest crediting is low and/or expenses are high, then ten or twenty years down the road, your cash value could be completely depleted. And, once it reaches zero, you either have to pay a prohibitively expensive premium immediately, or let the policy lapse. These are two bad results that can be avoided by letting us investigate your policy today, and without any obligation.

If you have owned your cash value life policy for at least eight years, there’s a 65% chance we can refi (lower) your premiums forever without compromising your coverage. And yes, 35% of the time our free Snapshot analysis reveals that the policy owner should stay right where they are, so there’s no sales pressure here. The good news is that as consumer advocates, we look out for YOU, not the insurance company. That is why we are offering for free what most financial advisors would almost certainly charge you for. So, since you have nothing to lose by doing so, why not at least let us complete the analysis and make sure you’re getting the best deal?

To receive your free Snapshot analysis, simply click on the big blue button on our home page and follow the instructions. You only need your policy number, the carrier name and your electronic signature. THAT’S IT! We do the rest.

Of course, you can by-pass all this content by just calling (562) 212-4923 and we’ll walk you through it all.

Robert Senske Co-Founder